Tips to position yourself to better navigate an evolving financial landscape

In the world of investing, the ebb and flow of global financial conditions are critical indicators, often steering the course for savvy investors. Currently, the financial landscape is presenting an intriguing scenario, as conditions are deemed the most favorable since August.

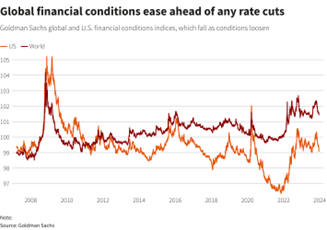

The speculative anticipation of future interest rate cuts has contributed to the loosening of global financial conditions, but this very optimism could pose risks for exuberant stock and bond markets.

The Goldman Sachs Indicator

A key barometer in assessing global financial conditions is the widely followed index produced by Goldman Sachs. This index offers insights into the accommodativeness of financial conditions by tracking corporate borrowing costs and the ease with which companies can access funding through stock markets.

Currently, this index is signaling that global financial conditions are at their most accommodative since early August.

In March 2022, just before major central banks, including the U.S. Federal Reserve and the European Central Bank, embarked on aggressive monetary tightening campaigns to combat inflation, the index was at similar levels. The recent easing in financial market conditions is a notable departure from the trend of tightening observed in the preceding months.

Speculation on Interest Rate Cuts

What sets the current scenario apart is the feverish speculation surrounding future interest rate cuts. Investors and market participants are pricing in significant interest rate reductions in the coming year. This speculative sentiment is effectively unwinding some of the recent monetary tightening implemented by central banks. However, a potential risk arises if central banks interpret the relaxed funding environment as a rationale to maintain higher borrowing costs, contradicting market expectations.

Goldman’s U.S. Index

Zooming in on the U.S. perspective, Goldman’s U.S. version of the index paints a similar picture. Financial conditions in the United States are currently at their most accommodative since July 26. This suggests a notable shift in the prevailing sentiment and expectations regarding monetary policy, with implications for various asset classes.

Strategic Considerations for Investors

Monitor Central Bank Communications: Given the sensitivity of financial markets to central bank actions, investors should closely follow communication from major central banks. Any deviation from market expectations could have significant repercussions.

Diversification: As financial conditions evolve, maintaining a diversified portfolio becomes increasingly crucial. Diversification across asset classes and geographical regions can potentially help mitigate risks associated with sudden market shifts.

Scenario Analysis: Investors should engage in scenario analysis, considering both the potential outcomes of interest rate decisions and the broader economic landscape. Being prepared for different scenarios can aid in making informed investment decisions.

Stay Informed: Regularly update yourself on economic indicators, geopolitical events, and market trends. An informed investor is better equipped to navigate changing financial conditions.

Planning Matters

The current state of global financial conditions, marked by their most favorable stance since August, demands careful consideration from investors. The interplay between speculation on interest rate cuts and central bank actions creates a dynamic environment that necessitates strategic foresight.

By staying informed, diversifying portfolios, and conducting thorough scenario analyses, investors can work toward positioning themselves to navigate the complexities of the evolving financial landscape and make prudent investment decisions.

Important Disclosures

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Investing involves risk including the potential loss of principal.

This article was prepared by FMeX.

LPL Tracking #521614-01