The Return of “The Magnificent Seven”

“The Magnificent Seven,” a cinematic triumph in 1960, mirrored the resonance of audience adoration and critical acclaim. Emerging as one of the year’s highest-grossing films, it solidified its place not just as a commercial success but as a cherished Western classic. The film’s timeless narrative of valor, unity, and the fight against adversity struck a chord, earning it a revered status among moviegoers and critics alike. Its ensemble cast, led by luminaries like Yul Brynner, Steve McQueen and Charles Bronson, brought to life a tale of heroism and camaraderie that has endured over the years, cementing its position as an evergreen favorite in the Western genre.

In 2023, a resonant echo of concentrated leadership emerged in the stock market, akin to the “Magnificent Seven” legacy. This time, however, it wasn’t gunslingers but mega-cap technology companies that took the reins. The new “Magnificent 7,” featuring industry giants Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla, seized an overwhelming percentage of market gains, propelling the broader market skyward.

Like the characters in the film, these companies exhibited their prowess and unity, driving innovation and dominating market dynamics. Their collective strength and influence mirrored the unity of purpose seen in the classic film, underscoring a contemporary narrative of market leadership and technological advancement that captivated investors’ attention, much like the cinematic masterpiece captivated audiences of its time.

2023 Was a Great Year

The stock market closed out 2023 on a high note, with the S&P 500 climbing steadily for nine consecutive weeks, marking its most impressive weekly winning streak since 2004.

This surge came as a relief rally for risk assets, buoyed by a resilient economy, subdued inflation, and the Federal Reserve’s indication of ceasing rate hikes while foreseeing potential rate cuts throughout 2024. Despite grappling with a regional banking crisis and ongoing conflicts in Ukraine and the Middle East, the market remained robust.

The standout performers were the big technology stocks, particularly mega-cap companies like Apple, which soared by 48%, Microsoft with an impressive surge of almost 57%, and Nvidia skyrocketing by a staggering 239%. Driving this surge, the tech-focused Nasdaq Composite closed the year with its strongest performance since 2020.

Let’s do the numbers:

| Close | 2023 | |

| DJIA | 37,690 | 13.70% |

| S&P 500 | 4,770 | 24.20% |

| NASDAQ | 15,011 | 43.40% |

| Russell 2000 | 2,027 | 15.10% |

| MSCI EAFE | 2,236 | 15.00% |

| Bond Index* | 2162.00 | 5.10% |

| 10-Year Treasury | 3.90% | 0.30% |

2023 Versus 2022 – A Tale of Two Years

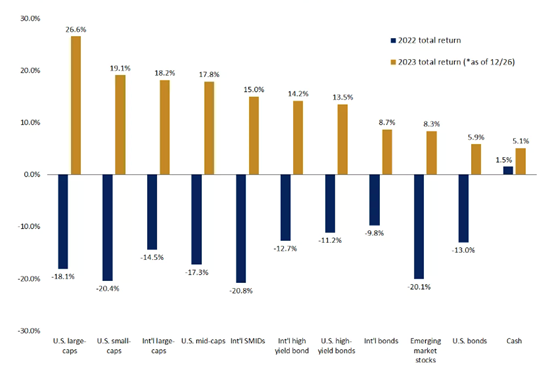

The year 2023 commenced with gloomy forecasts and recession fears as 2022 was a year investors wanted to quickly forget. But 2023 was a year investors want to never forget, as it culminated in a surge of optimism and robust performance across diverse asset classes.

Yet 2023 was not without its challenges, as Investors navigated through a landscape fraught with suspense and obstacles, including the steepest borrowing costs witnessed in over 20 years, a regional banking crisis, and geopolitical turbulence. However, the economy’s resilience, a trend toward lower inflation, the conclusion of Federal Reserve tightening (hopefully), and the enthusiasm surrounding artificial intelligence (AI) outweighed these challenges, pushing almost all asset classes into very positive territory for the year.

Sector Returns in 2023

The overall trend for sector performance for each of the four quarters in 2022 and most of the 12 months was volatile, as the performance leaders and laggards rotated all year. And interestingly, the last three quarters of the year saw a mini-pattern develop that investors are hopeful is not repeated in the first quarter of 2024 as:

- Q2 saw 9 sectors advance;

- Q3 saw 10 sectors decline; and

- Q4 saw 10 sectors advance.

In addition, the range in 1-year sector-returns was exceptionally wide, with the Information Technology sector leaping more than 60% and the Utilities sector losing more than 10%. That’s volatility.

Here are the sector returns for 2023:

| S&P 500 Sector | 2023 |

| Information Technology | +60.32% |

| Energy | -3.16% |

| Health Care | +1.02% |

| Real Estate | +9.50% |

| Consumer Staples | -2.22% |

| Consumer Discretionary | +44.25% |

| Industrials | +16.99% |

| Financials | +11.19% |

| Materials | +10.55% |

| Communication Services | +58.46% |

| Utilities | -10.46% |

Reviewing the sector returns for 2023, we saw that:

- 8 of the 11 sectors were painted green for the year;

- The Information Technology sector had a great year, leaping more than 60%, driven by the big tech names (the Magnificent 7);

- The value and defensive names (Energy, Utilities, Consumer Staples and Health Care) all underperformed; and

- The growth sectors (Information Technology, Consumer Discretionary, and Communication Services – again think Magnificent 7) all outperformed.

Markets Around the World Performed Great in 2023 Too

Great performance in 2023 was not confined to the U.S., however, as global markets also turned in a positive year. In fact, of the 36 of the developed markets tracked by Morgan Stanley Capital International (MSCI), all of them were positive, with 33 of the 36 turning in double-digit gains (incidentally, in 2022, 35 of the 36 indices recorded double-digit losses).

And it was almost as good for developing markets, as 30 of the 40 developing markets tracked by MSCI turned in positive numbers in 2023, with most gaining less than 10% (in 2022, 30 of the 40 indices lost more than 20% and many markets in Eastern Europe lost more than 70% in 2022).

The following shows the range of 2023 returns from markets around the world:

| Index Returns | 2023 |

| MSCI EAFE | +15.03% |

| MSCI EURO | +22.18% |

| MSCI FAR EAST | +12.77% |

| MSCI G7 INDEX | +22.97% |

| MSCI NORTH AMERICA | +24.45% |

| MSCI PACIFIC | +12.07% |

| MSCI PACIFIC EX-JAPAN | +2.06% |

| MSCI WORLD | +21.77% |

| MSCI WORLD EX-USA | +14.77% |

Asset Class & Style Performance

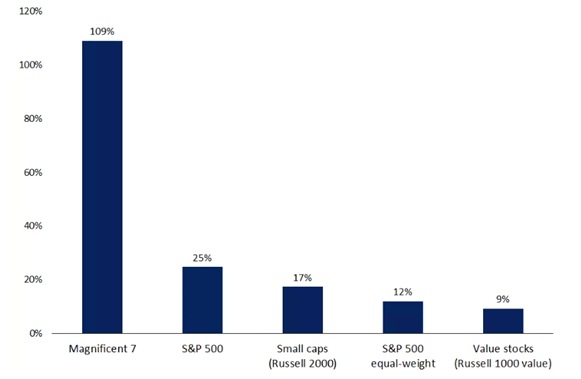

2023 was positive for most investors, and as is usually the case, asset class and style did play a role in determining one’s overall total performance returns. For the year, Growth (+37%) trounced Value (+12%) and the mega-cap names (especially those Magnificent 7 ones) trounced the smaller-cap names.

| Index Returns | 2019 | 2020 | 2021 | 2022 | 2023 |

| Global REITS | +24.4% | -10.14% | +32.6% | -23.7% | +10.9% |

| Value | +22.7% | -0.4% | +22.8% | -5.8% | +12.4% |

| DM Equities | +28.4% | +14.1% | +22.3% | -17.7% | +24.4% |

| Growth | +34.1% | +34.2% | +21.4% | -29.1% | +37.3% |

| Commodities | +7.7% | -3.1% | +27.1% | +16.1% | -7.9% |

| Global Agg | +8.8% | +9.2% | -4.7% | -16.2% | +5.7% |

| Small Cap | +26.8% | +16.5% | +16.2% | -18.4% | +16.3% |

| MSCI EM | +18.9% | +19.8% | -2.2% | -19.7% | +10.3% |

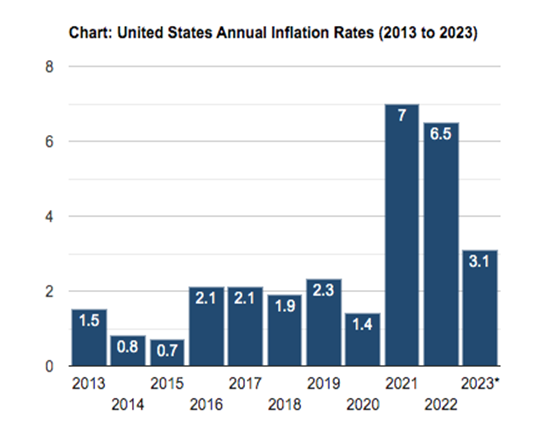

Inflation Retreated in 2023

The significant relief from inflationary pressures played a pivotal role in fostering positive market trends, offering a respite for both the Federal Reserve and the economy. After reaching its pinnacle at 9.1% in June 2022, the Consumer Price Index (CPI) underwent an impressive decline, slashing by two-thirds. This dramatic reduction firmly solidified disinflation as the prevailing theme defining the landscape of 2023.

In fact, according to U.S. Labor Department data published on Dec. 12th, the annual inflation rate for the United States was 3.1% for the 12 months ended November (final 2023 inflation data will be released in January 2024).

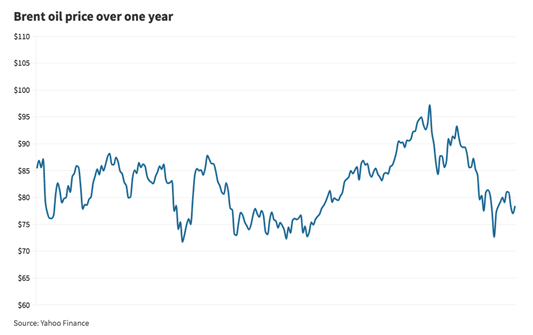

Oil Helped Drive Inflation Down

The decline in oil and gas prices played a pivotal role in bringing the headline CPI closer to 3%. In fact, much to the surprise of so-called “experts” who had predicted higher oil prices for 2023, crude futures faced a decline of more than 10%, marking their most substantial annual drop since 2020.

This downward trend unfolded amidst geopolitical tensions in the Middle East and apprehensions regarding the oil production capacities of key global producers. The Organization of the Petroleum Exporting Countries (OPEC) is presently reducing output by approximately six million barrels per day, constituting roughly six percent of the global supply and there were geopolitical tensions bubbling at the end of 2023 that are sure to bring more volatility to energy markets.

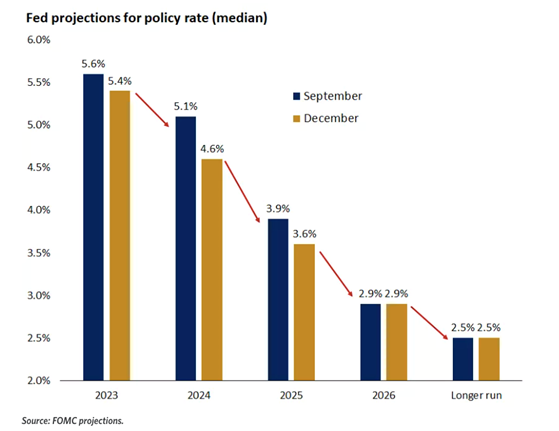

The Federal Reserve Ended Its Rate-Hiking Cycle (Hopefully)

The next Federal Open Market Committee (FOMC) meeting will be held in late January of 2024 and many expect the Fed to hold rates steady at a target of 5.25%-5.50% and hope that there might be several rate cuts in 2024 as inflation eases.

The FOMC raised interest rates to 5.25%–5.50% at its July 2023 meeting, then marking 11 rate hikes in an effort aimed at curbing stubbornly high inflation. But the FOMC did hold rates steady during their most recent meeting in December 2023, as well as the prior September and November meetings.

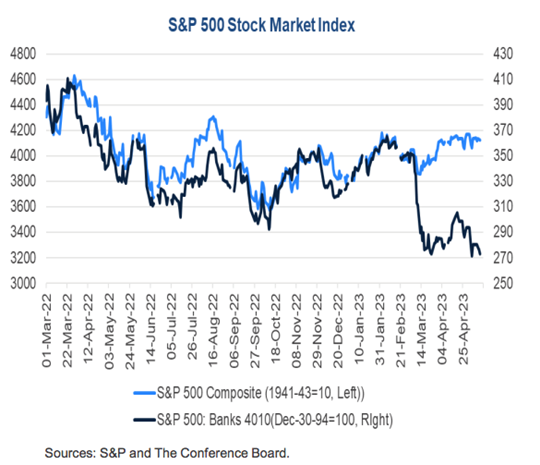

A Short-Lived Banking Crisis

In March, the focus momentarily shifted from inflation concerns to worries about financial stability. Confidence in the banking system took a hit following the failures of Silicon Valley Bank and Signature Bank, causing ripples that affected First Republic Bank and Credit Suisse.

These developments briefly wiped out the S&P 500’s year-to-date gains, but prompt actions by policymakers helped contain fears of a broader crisis. The Federal Reserve, Treasury, and Federal Deposit Insurance Corporation (FDIC) safeguarded all depositors, covering funds beyond the FDIC insurance limit of $250,000 at the failed banks. Additionally, the Fed established a new lending facility to furnish loans, ensuring banks could meet their depositors’ demands.

The Magnificent 7 Dominated

In 2023, a prominent theme emerged in the form of concentrated market leadership, notably driven by mega-cap technology companies that propelled the broader market upward. By the year’s midpoint, the “Magnificent 7” (comprising Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla) accounted for a staggering 90% of the S&P 500 gains. This surge was underpinned by advancements in AI, captivating investors’ attention and taking center stage in innovation. However, leading up to mid-November, the broader landscape for stocks appeared stagnant, primarily influenced by concerns surrounding the delayed impacts of elevated interest rates. This sentiment was exemplified by the S&P 500 Equal Weight Index, which maintains equal weighting for all included stocks, remaining unchanged for the year, starkly contrasting the exceptional 100%+ gain observed for the Magnificent 7.

PRICE RETURNS IN 2023

Thoughts on 2024

Over the years, the market has shown remarkable resilience, surging to total returns exceeding 25% an impressive 27 times, including the standout performance of 2023. This historical pattern underscores a significant aspect: such substantial growth occurs more frequently than anticipated, constituting over a quarter of the market’s track record. It’s a compelling reminder that while 2023 showcased remarkable results for investors, such significant upswings are not as rare as they might seem. An intriguing trend emerges when observing these instances of remarkable market surges. Notably, among the years where the market soared by 25% or more, six out of 27 followed a preceding decline of 10% or greater, while 11 occurred after a negative year. This highlights the market’s ability to rebound strongly even after periods of considerable

downturns, emphasizing the importance of resilience and persistence in investment strategies.

What’s particularly striking is that following these notable upswings, the average total return in the subsequent years averaged a healthy 10.2%. While some years saw extraordinary gains, like the prosperous 1927 boasting a 44% total return, others faced downturns, such as the less favorable 1936 with a 35% market decline. These fluctuations underscore the market’s dynamic nature and highlight the importance of staying invested for the long term, weathering both highs and lows to capture the market’s enduring potential.

Sources: conference-board.org; cmegroup.com; cointmarketcap.com; motleyfool.com; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. All indexes are unmanaged and cannot be invested into directly.

Past performance is no guarantee of future results.

Because of their narrow focus, investments concentrated in certain sectors or industries will be subject to greater volatility and specific risks compared with investing more broadly across many sectors, industries, and companies.

S&P 500 Index: The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization US stocks. S&P 500 Equal Weight Index: The equal-weighted version of the widely-used S&P 500 where each company is allocated a fixed weight at each quarterly rebalance.

The NASDAQ Composite Index measures all NASDAQ domestic and non-U.S. based common stocks listed on The NASDAQ Stock Market. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by FMeX.

Tracking #523716